The Story of Toffil’s Stocks Frontier (370090)

In this post, we will cover recent issues, investor sentiment analysis, target stock prices, and earnings analysis for the Pureantia stock price outlook.

In this post, we will cover recent issues, investor sentiment analysis, target stock prices, and earnings analysis for the Pureantia stock price outlook.

Pureantia Company Overview

Pureantia is a camera module assembly, inspection equipment development and manufacturing company whose main businesses are automotive electrical and mobile camera assembly, inspection equipment development and sales, and core parts development and sales for automation equipment. Among them, the electrical equipment business is the main business, and the performance of this sector has a significant impact on overall performance. performance of key business units

Although the mobile equipment division showed a decline in performance in the first half of the year, sales and operating profit grew year-on-year due to strong performance in the electrical equipment and parts divisions. This allows you to use these The performance of the two divisions is expected to drive the company’s future growth.

Korean Sutra

outlook for the second half of the year

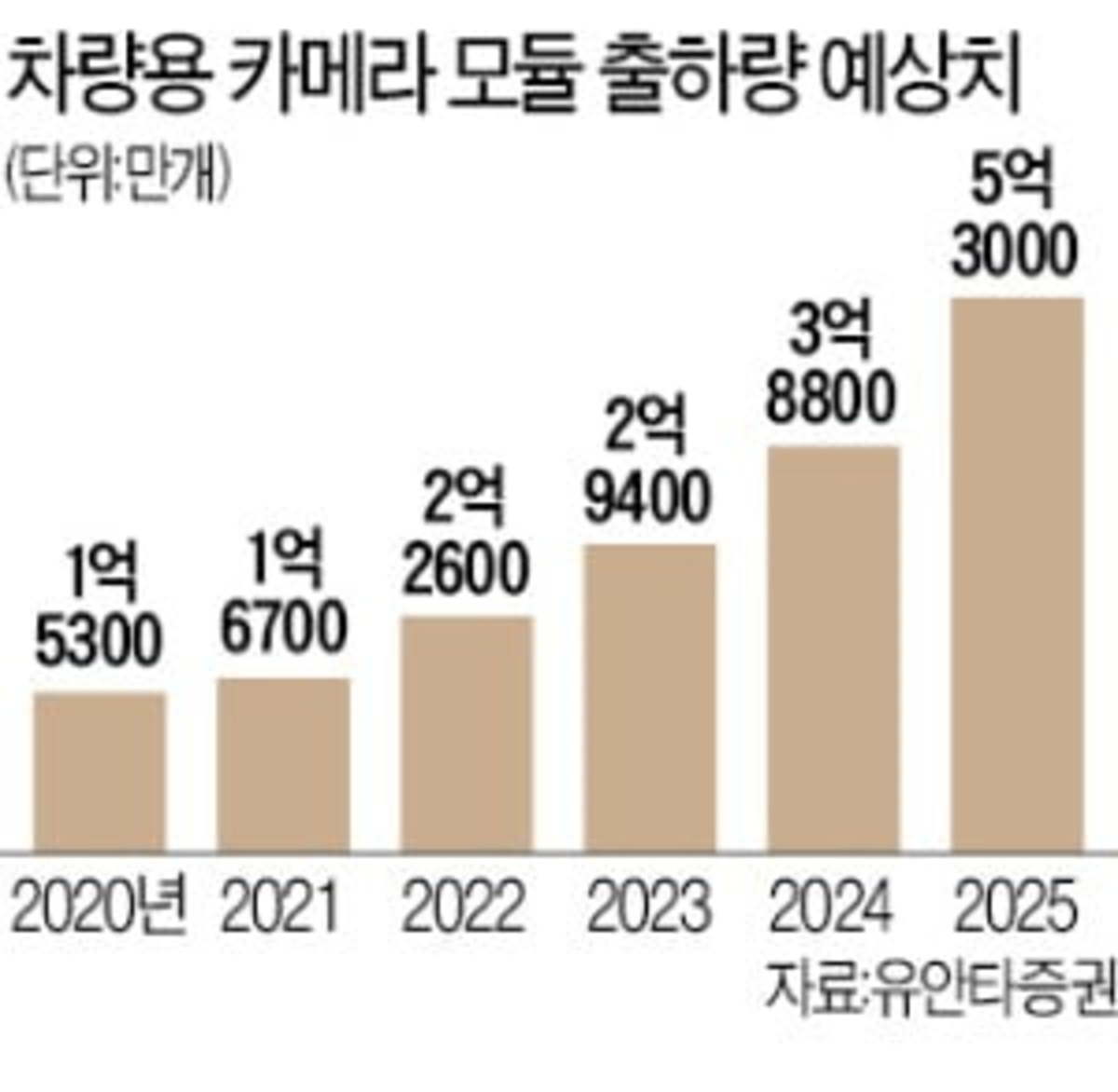

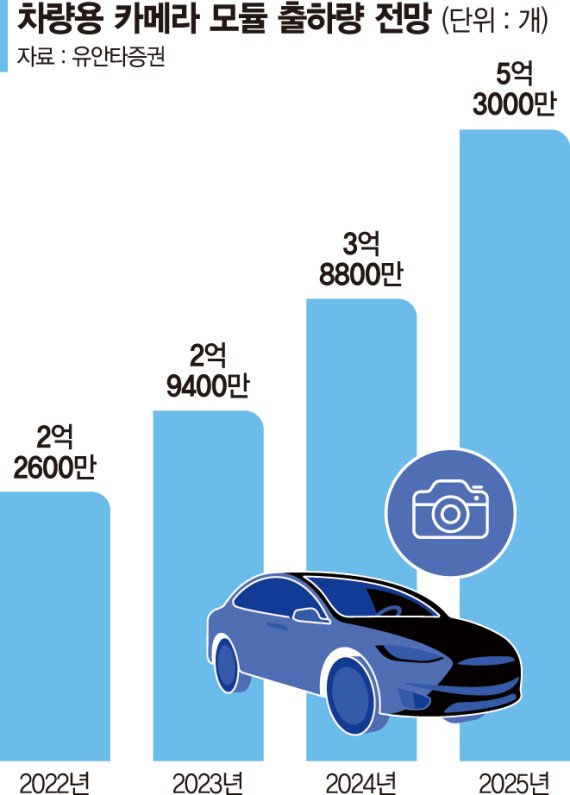

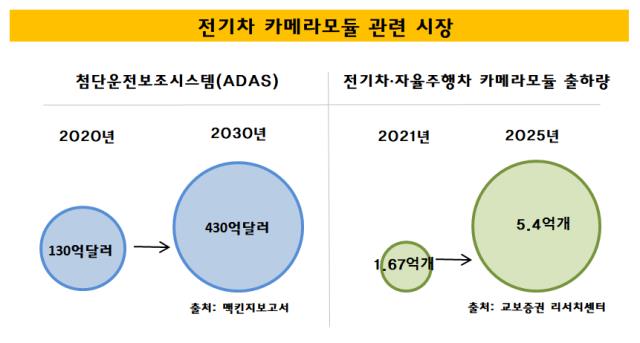

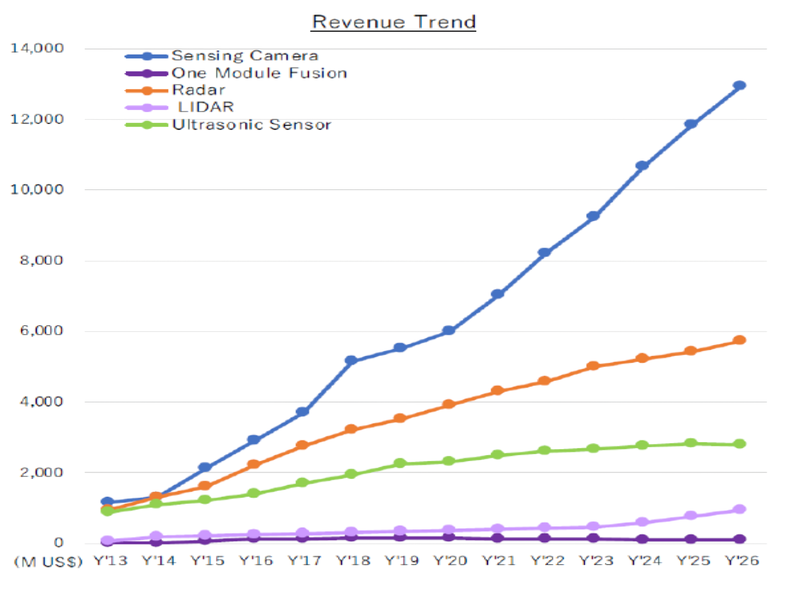

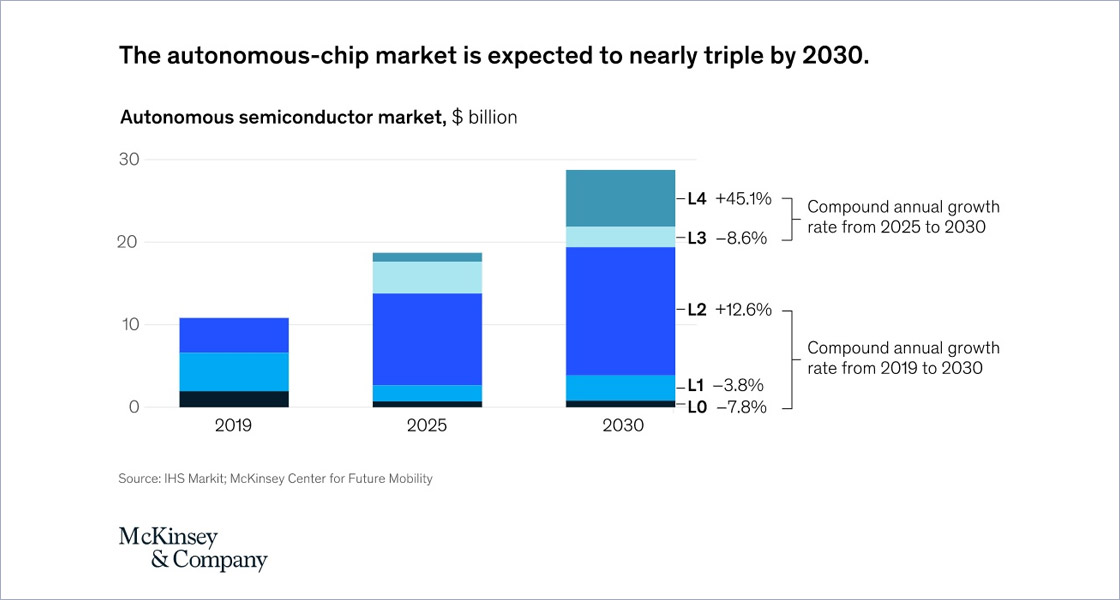

New investments are expected to begin in earnest due to mass production of self-driving cars and increased demand for cameras. In other words, we need to pay more attention to orders in the second half of the year than to quarterly earnings growth. self-driving market and purantia

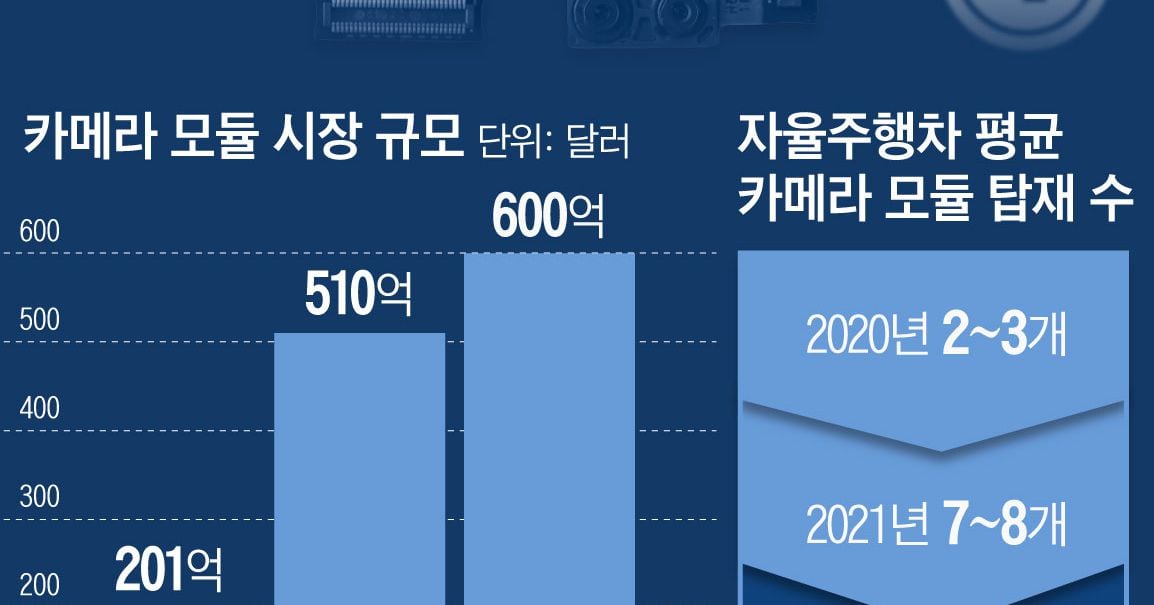

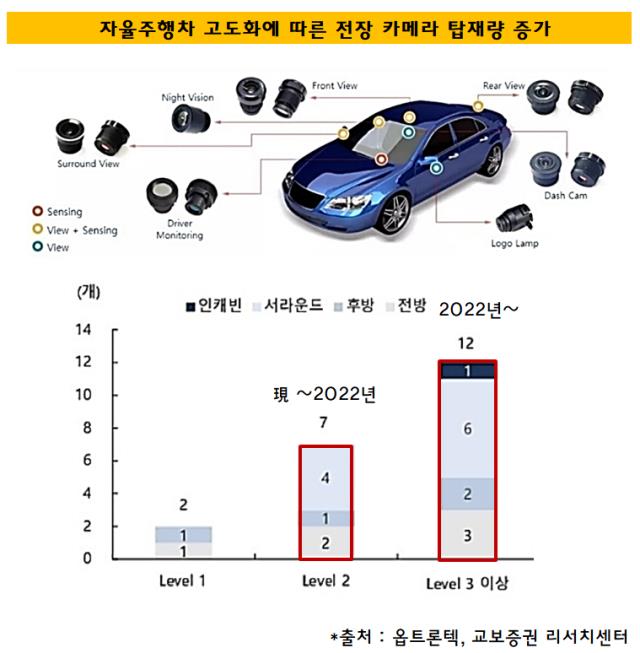

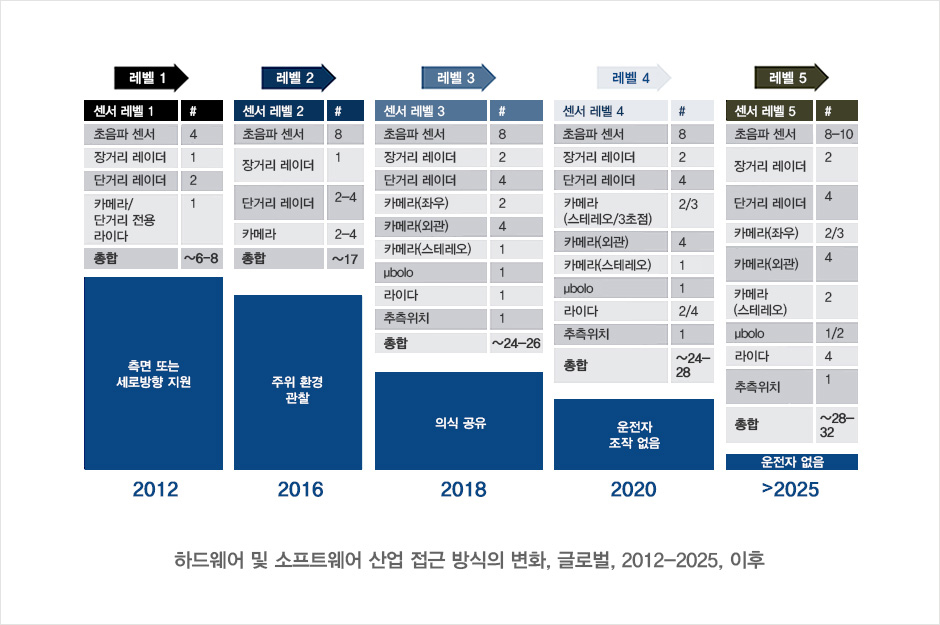

As the self-driving car market grows faster, Pureantia’s sales of electrical camera equipment are expected to grow high. In particular, with the development of ADAS (Advanced Driver Assistance Systems), the number of cameras installed in vehicles is increasing. For example, in the case of self-driving level 2, the number of cameras per vehicle was 7 to 8, but in the case of level 3, at least 12 cameras are required. This is an important indicator of the increase in sales of Pureantia’s electrical camera equipment.

purantia

Pureantia Investor Sensitivity Analysis

Let’s take a look at the current investor sentiment of pure investors. Using Python, I brought all the comments from the Pureantia Investor Bulletin Board in the domestic investment community.

The results of the recent request for emotional analysis of 100 pure-related comments on the financial analysis artificial intelligence model learned by Tufil are as follows. Financial Analytics Artificial Intelligence Model Answer From Traderfeels bot

The results of the recent request for emotional analysis of 100 pure-related comments on the financial analysis artificial intelligence model learned by Tufil are as follows. Financial Analytics Artificial Intelligence Model Answer From Traderfeels botTop 3 Positive Opinion:1. Investmenters expectations: The stock community has been positive response to FUELTANTITY OF FUELTRACTION.investors pointed out as positive factors for the future growth of pure future growth, and automobile market, especially as a positive factor of electrical vehicles and automobile market.2. rising trend:There were many comments that the price of pure stock prices are continuously rising.Investors expectations to investment successfully and investment successfully investment.3. positive performance: The future performance of computer tier.The investors expressed expectations that the increase in pure business profit, and this would affect the investment decision on pure stock.negative issue Top3:1. Stock volatility: There have been concerns about price volatility in Furyantia shares. Some investors were concerned about the fall after the stock price soared, which negatively affected their investment decisions.2. Investment Risk: Some comments pointed to the risk of investing in Furyantia stocks. Some investors emphasized the risks of investing in stocks and expressed their opinion that investment decisions should be cautious.3. Negative market reaction: There was also a negative market reaction to Fureantia. Some investors anticipated a fall in Furyantia’s stock price, which adversely affected investment decisions. Percentage of Positive and Negative Opinions:There was a more positive opinion in the stock community about Pure Stock. Investors expressed expectations for Fureantia’s future growth potential and positive earnings prospects, which reflected the stock’s upward trend. However, there were concerns about stock price instability and investment risks, so we should be careful in making investment decisions.There was a more positive opinion in the stock community about Pure Stock. Investors expressed expectations for Fureantia’s future growth potential and positive earnings prospects, which reflected the stock’s upward trend. However, there were concerns about stock price instability and investment risks, so we should be careful in making investment decisions.young on topIt’s a target stock price for the frontierPureantia 1 year (left) single seal (right) chartThis is not an advice for buying and selling, so please refer to it as a technical analysis.Currently, the average consensus of the securities industry’s target stock price is 38,000 won. The stock price as of July 17th was 32,850 won, leaving a 16% increase until the pure target stock price. According to technical analysis, if the stock price of Florentia continues to rise, the primary resistance section is expected to be between KRW 33850 and KRW 34150. If stock prices experience adjustment, the first support section is 28,500-28,800 won, and the second support section is 26,950-27150 won. Purantia performance analysisCurrently, the average consensus of the securities industry’s target stock price is 38,000 won. The stock price as of July 17th was 32,850 won, leaving a 16% increase until the pure target stock price. According to technical analysis, if the stock price of Florentia continues to rise, the primary resistance section is expected to be between KRW 33850 and KRW 34150. If stock prices experience adjustment, the first support section is 28,500-28,800 won, and the second support section is 26,950-27150 won. Purantia performance analysisSales and operating profit rose from 15.1 billion in 2020 to 22.2 billion in 2021, reaching 26.9 billion in 2022. Estimated sales in fiscal 2023 are 54.8 billion, which is on the rise. Operating profit also rose from -1.5 billion in 2020 to 1.2 billion in 2021, reaching 1.6 billion in 2022.Net profit and operating profit ratio analysis net profit rose from 2.2 billion won in 2020 to 2.6 billion won in 2021 and was reported to 2 billion won in 2022. The operating profit ratio increased from -9.96% in 2020 to 5.5% in 2021 and recorded 6.07% in 2022.The financial ratio analysis debt ratio decreased significantly from 67.11% in 2020 to 37.76% in 2021, and further decreased to 27.61% in 2022. The retention rate decreased from 817.69% in 2020 to 308.08% in 2021, but rose to 865.73% in 2022.The stock price-related index analysis ratio (PER) is expected to be 72.18 times in 2022 to 19.80 times in 2023, and the return on equity (ROE) is expected to be 23.82% in 2023 from 7.74% in 2022.Dividends It is confirmed that there was no payment of the Furantia dividend in the last three years.Overall, Frontier sales and profits are continuously growing, debt ratios are falling, and a sound financial structure is maintained.I finished postingPureantia is a manufacturer of electrical camera module automation equipment and plays a major role in the high-growth ADAS and autonomous driving markets. In addition, as self-driving levels rise, the number of cameras required per vehicle is increasing, and sales of Pure’s electrical camera equipment are expected to grow.Look at the news about domestic companies that just came outObgen Stock Outlook, Target Stock Price [Naver Ukraine Reconstruction & Performance Analysis]Toffil’s Stock Story Obzen (417860) In this post, recent issues and investors’ blog.naver.com for Obzen stock price outlookObgen Stock Outlook, Target Stock Price [Naver Ukraine Reconstruction & Performance Analysis]Toffil’s Stock Story Obzen (417860) In this post, recent issues and investors’ blog.naver.com for Obzen stock price outlookAlchella stock price outlook, target stock price [Hyperclover & Incheon Airport facial recognition AI & Performance] Toophil stock story Alchella (347860) In this post, recent issues and investors’ blog.naver.com for Alchella stock price outlookAlchella stock price outlook, target stock price [Hyperclover & Incheon Airport facial recognition AI & Performance] Toophil stock story Alchella (347860) In this post, recent issues and investors’ blog.naver.com for Alchella stock price outlookAlchella stock price outlook, target stock price [Hyperclover & Incheon Airport facial recognition AI & Performance] Toophil stock story Alchella (347860) In this post, recent issues and investors’ blog.naver.com for Alchella stock price outlookdivinitydivinity

![[돌곶이 생활문화센터] 돌센~우쿨렐레(6회) 마지막 수업 [돌곶이 생활문화센터] 돌센~우쿨렐레(6회) 마지막 수업](https://cen.sobaekmnc.kr/wp-content/plugins/contextual-related-posts/default.png)